지인이 집에 놀러오셔서 간만에 세상 돌아가는 이야기, 윤석열 이야기, 주식이야기를 많이 했는데... 요즘은 핸드폰(폴더형)에서 주식 차트보려면 이 사이트만을 쓴다고 한다. 여러가지 기능이 많아서 와 놀라운데 했었는데,내가 직접 써볼려고 해도 영 적응이 안된다.

https://www.tradingview.com/chart/exLy5GdL/?symbol=AMD

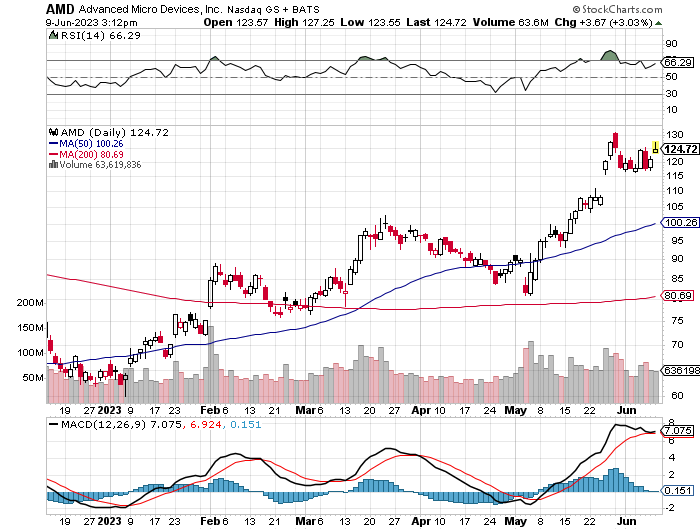

주식 차트를 예쁘게 그려주려면 이 정도는 기본으로 제공해 주고 강력한 기능을 더 해줘야 하는데, 이런 차트를 만드는데 오래걸리면 다른 기능이 아무리 좋아도, 손이 잘 안가는데...

https://stockcharts.com/h-sc/ui?s=amd

시간이 지나면 익숙해 지면 그 강력한 기능을 쓸 수 있을려나...

'경제이야기 > Stock' 카테고리의 다른 글

| 이번주 미국주식 어닝 2023/10/30 주 (0) | 2023.10.31 |

|---|---|

| 이번주 미국 주식 실적발표 (0) | 2023.10.24 |

| 2023-Apr-25 미국 주식 실적발표 earning (0) | 2023.04.25 |

| 이번주 실적발표 Earnings 2023-04-17 week (0) | 2023.04.18 |

| Spring Black Friday - Home Depot (0) | 2023.04.17 |