Ford가 undervalue되어있어 130% 더 오를수 있다는 얘기. Stock Buy back을 더 해줘야 한다는데... 흐뭇해지는 얘기지만 현실성은 좀 부족하네요. 이친구는 어떤게 계산하는지 따라해봐야겠네요.

----------------------

Summary

- Ford Motor is substantially undervalued on a free cash flow basis.

- I calculate an intrinsic value of $37 based on Ford Motor's free cash flow to equity and based on moderate growth assumptions.

- Ford should follow General Motors' lead and announce a voluminous stock buyback.

- Ford Motor's shares have more than 130% upside potential.

Ford Motor (NYSE:F) is one of the most undervalued companies in the stock market right now. Ford Motor does not only offer a solid dividend yield of 3.70%, but also substantial capital appreciation potential. In order to calculate Ford Motor's intrinsic value, I have derived Ford Motor's free cash flow to equity, a measure that shows how much cash is available for return to shareholders. The free cash flow to equity includes debt cash flows, debt proceeds and repayments, which are easily pulled from the firm's 10-K filing with the SEC.

General Motors (NYSE:GM) recently announced a major share buyback program, about which I wrote here. Share buybacks are financed out of a company's free cash flow to equity, which is why I use this measure to calculate Ford's indicative fair value.

Intrinsic value estimate

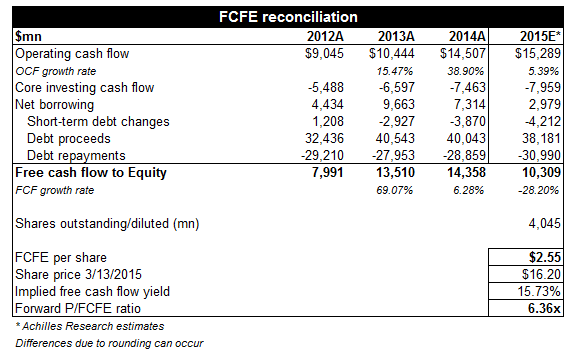

The table below contains Ford Motor's operating-, core investing- (capital expenditures, no inclusion of finance receivables, operating leases and sales/purchases of marketable securities) and debt cash flows from Ford Motor's cash flow statements for the years 2012-2014 (Source: Recent Ford Motor 10-K SEC filing). The table also includes my cash flow estimates for 2015.

The free cash flow to equity sums up operating, investment and debt-related cash flows. The resulting free cash flow to equity depicts the amount of cash that can be distributed to shareholders in the form of dividends and share buybacks.

I estimate that Ford Motor will be able to rake in $10.3 billion in free cash flow to equity in 2015, part of which is driven by positive net borrowings. On a per share basis, I estimate that Ford Motor can earn approximately $2.55 in FCFE in 2015, which translates into a P/FCFE ratio of just 6.4x. In other words, given the assumptions outlined below, Ford Motor's share price currently implies a near 16% FCFE yield.

(click to enlarge)

Source: Achilles Research, Company Financials

Source: Achilles Research, Company Financials

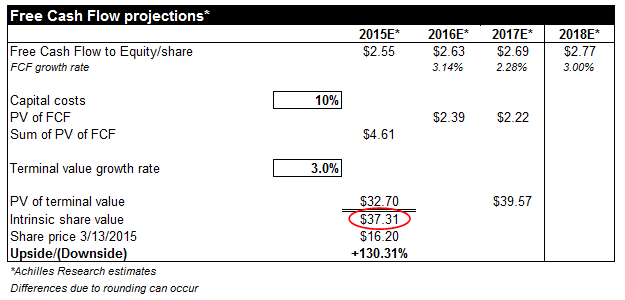

Using the derived free cash flow to equity per share as the basis for a discounted cash flow valuation model leads to the conclusion that Ford Motor is substantially undervalued.

Assuming moderate free cash flow to equity growth rates of about 3% in the short- and long-term, and applying an equity cost of capital rate of 10%, a two-stage FCFE valuation model leads to an intrinsic value of $37 per Ford share.

(click to enlarge) Source: Achilles Research, Company Financials

Source: Achilles Research, Company Financials

This high a value is not necessarily astonishing, because both operating cash flows and net borrowings are key drivers of the FCFE. Further, Ford Motor has had great success in growing operating cash flow: In the last year alone, Ford grew cash flow from operating activities by 39%.

Ford's high free cash flows lead to an intrinsic value that is way above its current share price of $16. Consequently, I think Ford Motor should follow General Motors lead here and announce a $10 billion share buyback to make better use of its cash. Ford can surely afford it.

Your Takeaway

Not everybody has to agree with the use of a FCFE valuation model for an auto manufacturer or with the growth assumptions embedded in such model. The derived value is an indicative fair value only.

However, the model goes to show that Ford Motor is substantially undervalued on a free cash flow to equity basis and that the company has a lot of resources available to fund stock buybacks.

Last but not least, Ford's free cash flow strength provides investors with a very wide margin of safety. Strong Buy.

'경제이야기 > Stock' 카테고리의 다른 글

| F How Ford And GM Compare In China (0) | 2015.03.17 |

|---|---|

| AA This Is Not The Same Alcoa (0) | 2015.03.17 |

| 20150315 아주 관심있는 종목 리스트 (0) | 2015.03.16 |

| Kiplinger's 2015 Feb - Future stock 추천 (0) | 2015.03.15 |

| 유럽동향 2015/03/12 (0) | 2015.03.13 |