공개자료만 모았음을 밝힙니다.

----------------------

Qualcomm Corp. moved to appease an activist investor and slash costs in response to a nearly 50% drop in quarterly profit.

The San Diego-based chip designer said would cut spending by $1.4 billion and consider restructuring its operations, such as separating its design and patent-licensing businesses. Qualcomm previously has considered splitting into two but always wound up rejecting the idea.

Chief Executive Steve Mollenkopf on Wednesday promised to take a fresh look at potential breakup options to reflect recent heightened competition. He told analysts Qualcomm now would examine “any and all ways to maximize shareholder value.”

The cuts include paring 15% of its full-time employees and “significantly” cutting its temporary staff. Qualcomm last year employed about 31,300 full-time and temporary employees, indicating that more than 4,500 workers could be affected.

Qualcomm also plans to cut $300 million from its annual share compensation grants to employees. The staff cuts will result in between $350 million and $450 million in restructuring charges, it said.

http://www.wsj.com/articles/qualcomm-plans-changes-to-company-structure-1437595996

----------------------

2015Q3 (날짜로는 Q2)

----------------------

회사에서 밝힌 회생방안(Strategic Realignment Plan)

DEFINITION OF 'SELLING, GENERAL & ADMINISTRATIVE EXPENSE - SG&A

Reported on the income statement, it is the sum of all direct and indirect selling expenses and all general and administrative expenses of a company.

Direct selling expenses are expenses that can be directly linked to the sale of a specific unit such as credit, warranty and advertising expenses. Indirect selling expenses are expenses which cannot be directly linked to the sale of a specific unit, but which are proportionally allocated to all units sold during a certain period, such as telephone, interest and postal charges. General and administrative expenses include salaries of non-sales personnel, rent, heat and lights.

----------------------

지난분기 Q2(일반 달력으로 Q1)

| Qualcomm Q2 2015 Financial Results (GAAP) | |||||

| Q2'2015 | Q1'2015 | Q2'2014 | |||

| Revenue | $6.894B | $7.099B | $6.367B | ||

| Gross Margin | 19.4% | 29.1% | 31.3% | ||

| Operating Income | $1.336B | $2.064B | $1.990B | ||

| Net Income | $1.053B | $1.972B | $1.959B | ||

| Earnings Per Share | $0.63 | $1.17 | $1.31 | ||

| Qualcomm Devices | |||||

| Q2'2015 | Q1'2015 | Q2'2014 | |||

| MSM Chip Shipments | 233M | 270M | 188M | ||

| Total Reported Device Sales | $75.8B | $56.4B | $66.5B | ||

| Est. reported 3G/4G device shipments | 384-388M | 284-288M | 295-299M | ||

| 3G/4G Device Average Selling Price | $193-$199 | $194-$200 | $221-$227 | ||

----------------------

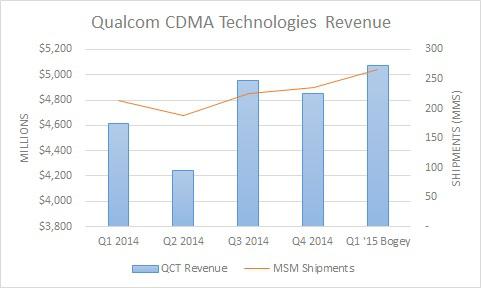

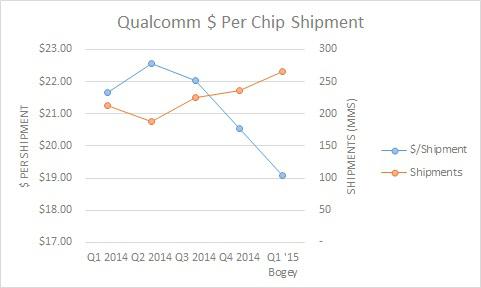

For fiscal Q1 2014, the company had QCT revenue of about $4.6 billion and MSM shipments of 213 million. These two metrics will be areas of focus for investors on Wednesday's earnings call. The other metric is revenue per shipment, which has been in decline:

http://seekingalpha.com/article/2856976-qualcomm-q1-earnings-4-things-you-need-to-know

----------------------

2014년

----------------------

2012년

----------------------

'경제이야기 > Stock' 카테고리의 다른 글

| 애플 2014 vs 2015 주가 비교 (0) | 2015.08.12 |

|---|---|

| MediaTek 2015년 7월 (0) | 2015.07.24 |

| 알코아(AA) 어닝시즌 개막 (0) | 2015.07.08 |

| Qualcomm에 대한 개인 투자자들의 생각 (0) | 2015.06.22 |

| 슈퍼개미 - 카이스트 화학과 김봉수 교수 (0) | 2015.06.21 |