Summary

- Ford is behind GM in China, although recent sales figures seem to favor the former.

- In absolute numbers, GM remains ahead of Ford and gives it a big advantage.

- GM shouldn't take its current position for granted because things can always change.

Ford (NYSE:F) and GM (NYSE:GM) are the two most prominent car manufacturers from the United States. Throughout their long history together, they have competed with one another and the two can be considered rivals. Neither of the two companies has a clear advantage over the other to be number one in the United States. They go back and forth as time goes by.

With that said, it can be argued that Ford has been the better of the two in recent years. For instance, while GM needed a massive government bailout to recover from bankruptcy at the height of the Financial Crisis in 2008/2009, Ford did much better and was able to keep its problems more or less under control.

However, the one consistent and constant advantage that GM has had over Ford is in the Chinese market. In China, GM is way ahead of Ford by a huge margin. Some of GM's brands such as Buick are doing very well there, even though they may be struggling elsewhere. That helps illustrate the level of success GM has managed to achieve in China.

The trend in China may be changing in favor of Ford

| GM | Unit Sales | % Change (Y/Y) |

| January 2015 | 339,781 | -2.4 |

| February 2015 | 261,072 | 1.3 |

Source: GM releases

| Ford | Unit Sales | % Change (Y/Y) |

| January 2015 | 112,599 | 19 |

| February 2015 | 79,384 | 8.7 |

Source: Ford releases

Recent sales figures from GM and Ford in collaboration with their Chinese partners seem to suggest that this advantage may be slipping. In fact, GMsales in China are actually down in comparison to the previous year. Ford, on the other hand, is doing much better with significant sales increases. Some would therefore argue that Ford is gaining on GM in a market where it has long trailed.

Ford versus GM in China

The latest sales figures come on the heels of other reports which indicate that Ford increased sales last year by over 19 percent in China. GM also did well with a 12 percent increase, but that's substantially below that of Ford. The tables below show the performance of GM and Ford over the last several years.

Furthermore, Ford has beaten GM for the last three years using this metric. You would have to go all the way back to 2011 for the last time that GM was able to post a higher number than Ford. It would seem that a pattern is beginning to appear.

| GM | Unit Sales | Unit Increase | % Increase |

| 2009 | 1,826,424 | | |

| 2010 | 2,351,610 | 525,186 | 28.8 |

| 2011 | 2,547,171 | 195,561 | 8.3 |

| 2012 | 2,836,128 | 288,957 | 11.3 |

| 2013 | 3,160,377 | 324,249 | 11.4 |

| 2014 | 3,539,970 | 379,593 | 12.0 |

| Ford | Unit Sales | Unit Increase | % Increase |

| 2009 | 440,619 | | |

| 2010 | 483,288 | 42,669 | 9.6 |

| 2011 | 519,390 | 36,102 | 7.4 |

| 2012 | 626,616 | 107,226 | 20.6 |

| 2013 | 935,812 | 309,196 | 49.3 |

| 2014 | 1,114,669 | 178,857 | 19.1 |

The market in China continues to grow

With China now being the largest market in terms of vehicles sold, it's important for automakers to do well there as best as they can. No car manufacturer can aspire to be number one globally without also having a strong position in China. Especially not with the Chinese market continuing to grow at a strong clip.

The China Association of Automobile Manufacturers ("CAAM") forecasts sales to grow by around 7 percent in 2015 to 25.1 million vehicles. That continues the steady expansion of the market as seen in recent years. The table below shows the total number of vehicles sold in the preceding years.

| | Unit Sales (in millions) | % Increase |

| 2009 | 13.64 | |

| 2010 | 18.06 | 32.4 |

| 2011 | 18.5 | 2.4 |

| 2012 | 19.31 | 4.4 |

| 2013 | 21.99 | 13.9 |

| 2014 | 23.5 | 6.9 |

Source: CAAM

Is Ford really doing better than GM in China?

It's important to note that while Ford may be posting higher sales figures than GM in terms of percentages, its sales are coming off a much lower base. Therefore, GM sales may seem smaller because the base is so much bigger. Ford's increases in percentages may seem bigger, but they also translate into much smaller increases in absolute terms.

Taking a closer look at the sales statistics shows that while Ford may have increases sales last year by over 19 percent and GM by 12 percent, GM sold 379,593 more vehicles. Ford had 178,857 more vehicles. In other words, GM sales increase in absolute numbers is more than twice that of Ford, even though Ford increased its sales by a higher percentage.

Conclusion

Bottom line, GM is still comfortably ahead of Ford in China despite the progress Ford has made. Even though Ford last year managed to sell more than one million vehicles for the first time in China, GM managed to do that a long time ago and is now at more than 3.5 million vehicles. GM's unit sales are easily over three times that of Ford. China remains a strength of GM.

Granted, GM had a headstart because it entered the Chinese market before Ford did. GM first entered China in the early part of the twentieth century and re-entered the market in the mid nineties. Compared to Ford's greater reluctance, GM placed much stronger emphasis on China than Ford did.

The former is now reaping the benefits of its decision and Ford is forced to play catch up in a market that GM projects could grow to 35 million (passenger and commercial) vehicles by 2020. If this turns out to be accurate, GM will be in an excellent position to take advantage and eclipse the competition.

To Ford's credit, it has managed to make impressive strides even though it's behind. For instance, it has managed to beat Japanese manufacturers such as Toyota (NYSE:TM) and has now surpassed them in sales. The key is to keep up the effort and it's possible that for Ford the best is yet to come.

With all that said, GM should not become complacent even if it doesn't have to worry too much about Ford. Frequent recalls like you have now and other technical defects don't exactly help your reputation when you're selling a product.

GM therefore shouldn't take its current position for granted. It would not be the first time that an automaker lost its leading position. After all, just because you're ahead in the race doesn't mean you've also won the race. The race is far from over.

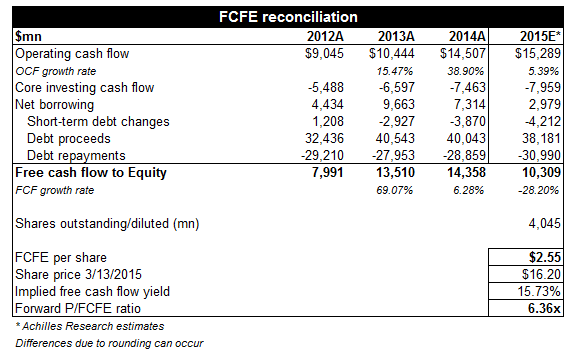

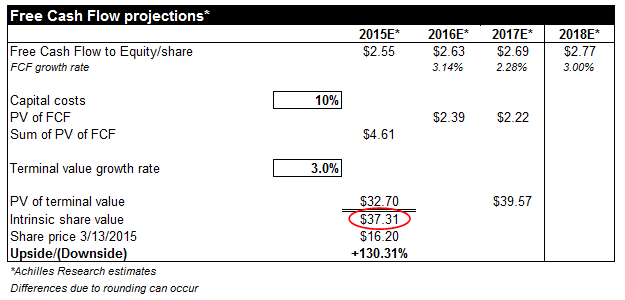

Source: Achilles Research, Company Financials

Source: Achilles Research, Company Financials Source: Achilles Research, Company Financials

Source: Achilles Research, Company Financials