QCOM에게는 안좋은 소식이네요. MSM은 삼성에게 까이고, Modem은 Apple에게 까이면 주요 매출 소스가 없어지게 됩니다.

Intel도 매출은 늘릴수 있지만 순익은 별로 없을거라고 하고, 최고 승자는 역시 경쟁붙여서 좋은 가격으로 납품받는 슈퍼갑 Apple이 되겠네요.

Intel은 modem만으로 끝내지 않고 AP도 같이 팔려고 할꺼라는데, Apple것이 너무 좋아 쉽게 넘어가지는 않을것 같고, 다만 Apple칩을 Intel Fab에서 생산하는것은 가능할지 모르겠네요. 삼성 견제도 되고요.

기사에 포함된 supplier 그래픽이 너무 좋네요.

Source : http://seekingalpha.com/article/2995886-apple-selects-an-intel-modem-a-glimpse-of-the-future

Summary

- The report that Apple has chosen an Intel modem for use in a future iPhone has encouraged Intel supporters.

- However, modem sales do not represent a “foot in the door” for Intel to sell mobile SOCs to Apple.

- Instead, it's an example of commodity chipmakers fighting for second tier supplier status to a major mobile device maker.

Venture Beat's report on March 10 that an Intel (NASDAQ:INTC) modem had been selected by Apple (NASDAQ:AAPL) for an upcoming iPhone targeted at emerging markets had Intel bulls salivating, but the celebration was short lived, after Intel lowered its guidance for the March quarter. The modem selection, if it goes through, does offer a glimpse of the future for Intel and Apple, but perhaps not the future Intel bulls have in mind.

Commodity Mentality

One of the things I've noticed in writing for SA for the past almost two years is that fans of Intel also tend to be fans of other large chipmakers, especially Qualcomm (NASDAQ:QCOM) and Nvidia (NASDAQ:NVDA). It's understandable in retrospect, since they share a common business model as commodity IC manufacturers. Writing in 2013, it struck me as odd, since it was apparent to me that the companies were on a collision course with business objectives that were ultimately mutually exclusive.

With the news that Apple had selected an Intel LTE modem rather than going with its long-time modem supplier Qualcomm, we witnessed just the sort of collision I had in mind. But the ramifications are greater than just the competition between Intel and Qualcomm.

The manufacture of systems on chip (SOCs) for mobile devices continues to shift from the commodity paradigm (Intel, Qualcomm, Nvidia) to the custom paradigm pioneered by Apple in the A4 SOC for the first iPad. More importantly for the commodity processor makers, consumer interest has continued to shift away from commodity PCs in favor of mobile devices. Intel's revised guidance for the March quarter was due primarily to declining PC sales, which Intel attributed to slower than expected business and XP refresh sales.

But PC sales have suffered for some time as a result of competition from mobile devices, and the increasing capability of mobile devices has many consumers and businesses thinking outside of the PC box. At the same time, Apple's success with the latest iPhone 6 and 6 Plus has made the custom paradigm dominant in the mobile device world. This has exerted a Darwinian survival pressure on commodity IC makers in general, and the industry has evolved in order to try to adapt to the new paradigm.

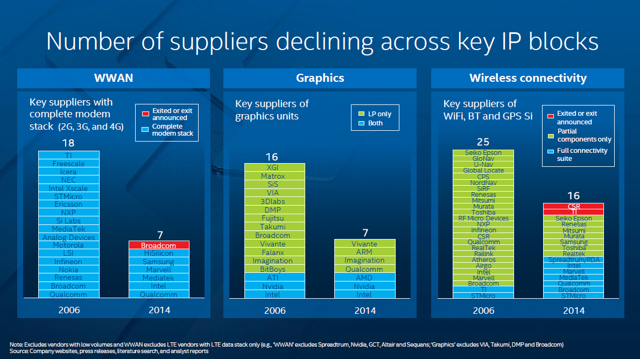

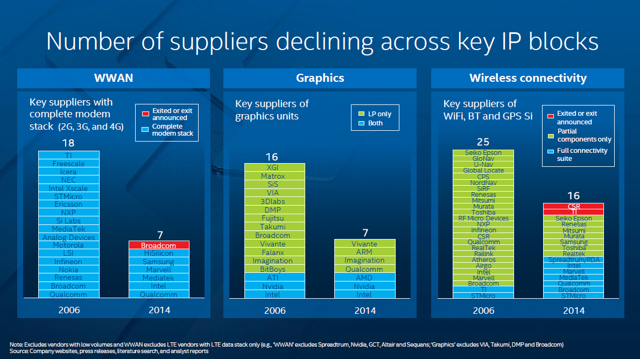

One of the features of this evolution has been considerable consolidation in the industry, with the Freescale/NPX merger being only the most recent. This was proudly highlighted in a chart by Intel CFO Stacy Smith for their annual Investor Meeting:

(click to enlarge)

Intel's naiveté about what the chart truly portends is almost touching. One of the very important survival strategies for the commodity IC makers is to become a preferred supplier of one of the big mobile device makers such as Apple. Here, commodity ICs still have a role to play by supplying functionality that hasn't been incorporated into the SOC.

But it's a role that must get smaller with time, as more and more functionality becomes integrated into the SOC. Thus the decline in the number of suppliers highlighted in the Intel chart.

The shrinking role for secondary commodity ICs has been masked by a number of near-term effects, not the least of which is the sheer growth in the mobile device business since the advent of the iPhone. Another effect has been the incorporation of greater functionality into smartphones themselves, which has often mandated accessory ICs for things such as motion sensors and communications devices such as the NFC radios incorporated into iPhone 6 to support Apple Pay.

The potential loss by Qualcomm of Apple's modem business brings into focus the ongoing pressure on commodity IC makers. The debut of Samsung's (OTC:SSNLF) Galaxy S6, which will use a Samsung custom SOC rather than a Qualcomm SOC provided the confirmation of the forward guidance provided by Qualcomm management in their fiscal 2015 Q1 earnings release:

Looking ahead, we have lowered our revenue outlook for our semiconductor business for the second half of the fiscal year and lowered our EPS expectations.

These changes are largely driven by the effects of:

A shift in share among OEMs at the premium tier, which has reduced our near-term opportunity for sales of our integrated Snapdragon processors and has skewed our product mix towards more modem chipsets in this tier (Apple iPhone 6 impact)

Expectations that our Snapdragon 810 processor will not be in the upcoming design cycle of a large customer's flagship device(Samsung Galaxy S6 impact)

Heightened competition in China (MediaTek, Rockchip, Spreadtrum, Intel)

Comments in bold parentheses are mine.

Qualcomm guided to effectively flat revenue for its fiscal 2015, based on the above listed effects. As the progenitor of the custom SOC paradigm shift, and the most successful, Apple has pushed Qualcomm into second-tier status as an accessory IC supplier, and forced the competition with Intel. This is not a big win for Intel. Intel wants to be the SOC supplier for the mobile devices of the world, just as it has been the CPU supplier for the PCs of the world. This is the Intel business model that so many still believe in.

Winning on Performance and Cost?

Those who believe in the continuing viability of this business model must assume that Apple will eventually choose Intel for its mobile devices for the same reasons it chose Intel for its personal computers: superiority in performance and cost.

This is an argument by analogy that doesn't hold up under close scrutiny. The superiority in performance and cost of x86 over PowerPC was a direct consequence of the small scale of PowerPC production. The revenue generated by PowerPC was never large enough to allow the manufacturers, IBM (NYSE:IBM) and Motorola, to keep up with Intel either in processor design or in manufacturing.

Apple had entered into the PowerPC alliance in the hope of developing a superior processing architecture to Intel. When it became clear that the PowerPC alliance had failed in that key objective, Apple had no choice but to switch to Intel.

In Intel vs. ARM, the tables have been turned, with the benefits of economies of scale favoring ARM architecture devices. Furthermore, the fabless model prevalent in the ARM world demonstrates that it's not necessary for fabless semiconductor makers to own the means of production. The ARM foundries can spread the benefits of production scale across multiple customers.

The success of the fabless model has enabled Apple to produce its own SOCs without significant cost penalty relative to commodity makers such as Qualcomm or even Intel. Although not everyone has accepted my assertionthat Intel Architecture is significantly cost-disadvantaged relative to ARM, I've not seen anyone assert that Intel can offer a cost advantage without some form of marketing subsidy.

So if Intel cannot offer a cost advantage to Apple, can it at least offer a performance advantage? I wouldn't completely rule this out, since it depends on the resourcefulness and creativity of the systems designers at Intel, which I wouldn't want to minimize. However, I think this is a low probability shot, for a number of reasons.

Intel's performance advantage as a result of manufacturing is likely to be short lived. Certainly, Apple's A8x has been demonstrated to be superior to Bay Trail fabricated on Intel's 22 nm process. Even as Intel began fabricating Cherry Trail (now Atom X5, X7) on its more advanced 14 nm process, Samsung was in production on its own Exynos SOCs, and probably Apple's next generation A-series, on 14 nm FinFET as well.

On the processor design front, Apple has demonstrated that it has a very talented design staff, along with the advantage of using a more modern and efficient CPU architecture in ARM. I doubt that there is any design advantage that Intel can achieve that Apple will not match with its own innovations.

Even if Intel could show some marginal performance advantage for Atom X5-7 compared to Apple's next A-series, Apple would still be reluctant to make a switch. The final advantage that Apple derives from its custom SOCs is that they're... custom. Customization allows Apple to tailor the SOC to the needs of the device. The better integration and efficiency afforded by SOC customization is part of what makes Apple mobile devices work so well. This is perhaps the most important consideration. Apple's custom SOCs give it an important discriminator in the highly competitive mobile device market.

Regardless of whom Apple chooses for its modem supplier, the winner will not be Intel, or Qualcomm, but Apple. Apple will get the best possible product at the lowest possible price, with suppliers falling all over themselves to get and keep Apple's business.