퀄컴이 2014년 10월에 발표했던 CSR인수를 마무리 지었습니다. $2.4B에 2100명, 20개 사이트를 인수하는 딜이었는데 상당히 큰 편이지요.

결국 IOT/IOE, Automotive시장을 겨냥한 수인데. 그때 인수를 발표한것은 잘한것인데 이제야 마무리 된것에는 좀 문제가 있네요. 이쪽 시장은 변화가 무쌍한데 결국 회사도 내리막길이고 빨리 대응도 못하고 문제가 좀 있네요. 멀리 본 수는 잘한것 같고요.

---------------------

작년 인수기사에 쓴 글

Today we announced our plans to acquire CSR, a leading innovator of multifunction semiconductor platforms and technologies focusing on automotive, consumer, voice and music, connectivity and location. Headquartered in Cambridge, England, CSR has more than 2,100 people working in over 20 locations worldwide.

뉴스에 보면 스마트폰이 slowdown하고 있어서 다른쪽에서 수익을 얻고자함이라고 회사 관계자가 소개하는것 같은데요. 다른것은 automotive밖에 안보이고요. 아래 회사소개 첫번째 두번째는 현재 우리가 가지고 있는 기술과 중복이네요. 애서로스가 WIFI는 좋은지 모르겠는데, BT쪽은 업계 leading회사와 차이가 큰것 같더라고요. 문제도 너무 많고. 그것을 catch-up하려는 것도 포함되어 있는것 같아요.(그럼 애서로스의 이부분과 통합해서 정리가 필요하겠네요)

첫번째 Voice & Music을 분석해보니, SOC에다가 WIFI/Bluetooth와 Codec까지 포함시킨것 같네요. 정말 좋은 아이디어 같아요. 응용 제품도 벌써 많이 있을것 같은데, 좋은생각이네요.

인수잘해서 잘되면 모르겠는데, 지금까지봐왔던 management로는 잘 융합시킬수 있을까 의문이 드네요.어제 인텔뉴스에서 인텔이 오래전에 새워졌다는 것을 알았네요.(

Intel is founded, July 18, 1968) 인텔은 아직도 PC는 독점으로 하고 있고, 업계리딩하는 분야가 있는데요, QCOM은 인텔처럼 50년동안 쌩쌩하기를 바랄수 없을것 같다는 생각이 드네요.

회사 소개 Page

---------------------

http://www.csr.com/about

- Voice & Music - delivering amazing audio with wireless audio technology platforms that provide exceptional sound and remove all the barriers to an immersive consumer listening experience

- Bluetooth® Smart – combining disruptive thinking, a hunger for innovation and powerful Bluetooth Low Energy platforms to simplify the complex challenge of developing breakthrough wireless products quickly

- Automotive Infotainment – making the vehicle a better place by combining wireless connectivity, location and audio technology to create immersive in-car infotainment that delights drivers

- Indoor Location -providing highly accurate location services that transform people’s mobile lifestyles - both indoors and out

- Document Imaging - providing innovative, cost-optimised document imaging platforms that deliver feature-rich printers that operate seamlessly with the latest PCs and mobile devices

---------------------

이 codec 알고리즘이 80년대에 개발된것이라고 하고 90년대초에 chip으로 만들어져 방송용으로 판적도 있네요. ADPCM과

psychoacoustic auditory masking에 기초했다고 하니(ADPCM + G.711 조합정도가 맞겠네요) 아주 대단한 break thru를 한건 아닌것으로 보여지고요. 발명한 사람이 회사를 차렸는지는 모르겟지만, 과학자가 아니라 타고난 엔지니어였다고 생각이드네요. 방송국 요구사항을 좀 안사람이었것 같네요. 두개의 조합으로 엄청난 비지니스를 만들어 냈네요. ISDN, IP폰용 코덱으로도 넣고, BlueTooth에도 넣었으니까요. 결국

CSR에 인수되고 퀄컴까지왔네요.

인생 완전 성공했네요. 하고 사람을 서치해봤더니...

창업하고 IT버블도 못보고 팔고 나온것 같네요. DTS에도 스카웃되고 결국 창업하고 말아먹고 다시 창업해서 살고 있는것같네요. 퀄컴까지 그대로 달려왔으면 좋았을텐데. 그래도 돈은 평범하게 벌지는 않았겠죠.

---------------------

Here's what's next for Qualcomm as it completes its $2.4 billion CSR buy

Qualcomm must adapt its business model to sell chips for the internet of things. Here’s how it will change.

Qualcomm’s $2.4 billion purchase of fellow chip company CSR closed Thursday, and while it wasn’t the biggest chip deal the industry has seen since Qualcomm said it would purchase the UK firm in October last year, this is a deal that has high stakes for Qualcomm—a company that is struggling to remake itself completely as its core cellular radio business becomes an ever smaller portion of its portfolio and activist investors pressure management.

Back in October, when Qualcomm QCOM -0.19% said it would purchase CSR, the company that was an initial champion of the now-popular Bluetooth technology found inside headsets, speakers and phones, it was seen as an obvious technology bolt-on acquisition. The addition of CSR would pair with Qualcomm’s interest in the internet of things and its $3.1 billion purchase of Wi-Fi chipmaker Atheros back in 2011. That’s still true today, but since the deal has been announced Jana Capital has taken a significant stake in Qualcomm and pressured the company to make changes. Last month it said it planned to lay off 15% of its workforce and said it would only focus on five businesses: mobile phones, the internet of things, data centers, small cells, and automotive.

Qualcomm also has the unenviable task of becoming a chip firm that has to adapt from having a relatively small and captive customer base to one serving a huge number of customers across many verticals. It also doesn’t have a radio technology or a limited number of competitors to lock customers in when it’s selling its Wi-Fi products, and soon its Bluetooth chips. In interviews with Fortune, Qualcomm and CSR executives explained how this deal will help Qualcomm handle some of these challenges both technically and strategically.

With CSR Qualcomm isn’t simply buying a radio chip firm as it did with Atheros. It’s also buying a company that makes an entire package of chips and software that fits into cars, headsets, and Bluetooth speakers, which dovetails nicely with Qualcomm’s own design philosophy of squeezing the brains of a smartphone into the same package with the radios and the graphics core. This integrated single-package approach lowers the cost of materials, saves on space, and tends to save on battery life. That’s essential for cell phones and the chips powering your Bluetooth headset.

CSR is also the keeper of some fancy software that turns Bluetooth radios, which are usually point-to-point radios, into a mesh network designed for the smart home or office. This CSRMesh technology is part of several big lighting products expected out in the fall, and parts of it will undoubtedly make it into the next generation of the Bluetooth standard.

Anthony Murray, formerly a senior vice president with CSR and now the senior vice president and general manager of IoE (Internet of Everything) at Qualcomm, explained that not only could we see the CSRMesh technology in Bluetooth, but one day we may even see Qualcomm supporting the Thread protocol created by Samsung, Nest and other big names in home automation on top of the Bluetooth radio.

“So far the Thread protocol has chosen to support one radio [ZigBee], but there are many of radios out there that it could support and there are advantages in using the Bluetooth radio in some use cases,” Murray said. “We can’t not support Thread given the strength of the supporters behind it.”

Qualcomm will also get a few esoteric technology holdings, such as a document imaging software business that may eventually be spun out, but for the most part CSR’s silicon and software will boost Qualcomm’s internet of things and automotive businesses easily. It also helps bring Qualcomm another set of managers who are used to selling to a wide range of customers and a more traditional customer base. Qualcomm historically sold radios based on technology it developed, which meant that once it convinced a network operator, such as Verizon, to buy into a technology, any company that wanted to sell a handset to that network operator had to license that radio technology from Qualcomm.

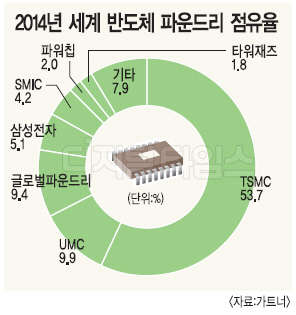

In many cases they bought the radio from Qualcomm too. As Qualcomm grew it developed the brains behind smartphones as well and integrated that tech with radios, which meant its customers were still the handset makers. Qualcomm grew along with the smartphone market, providing some of the most powerful application processors inside handsets. For the most part, it was the Intel of smartphones, with the exception of the iPhone once Apple decided to build its own chip.

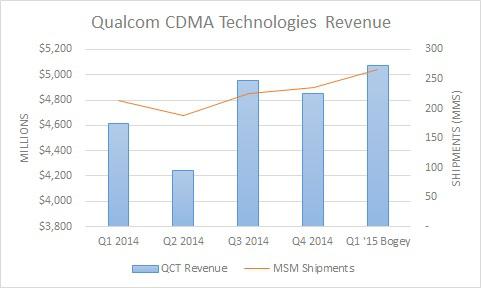

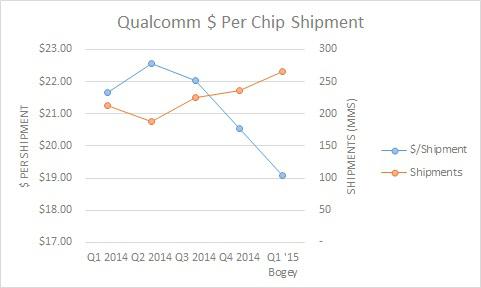

However, competition from China’s Mediatek was looming, and Qualcomm stumbled last year with one of its designs. It lost Samsung, which is still affecting its earnings. With these challenges in mind, diversifying its customer base isn’t a bad idea. Raj Talluri, senior vice president of product management, said Qualcomm brought in $1 billion from the internet of things in 2014 and expects to bring in 1.6 billion in 2015.

He said much of that comes from adding connectivity to existing devices, especially as a way to future proof them even if the manufacturer isn’t sure how they want to use it. “China is the most advanced and we see a lot of white goods with connectivity,” he said. “There are so many rice cookers that are shipping with connectivity in them.”

As for structuring Qualcomm to sell chips for thousands of different devices, from rice cookers to drones, as opposed to making a few different lines of chips for mobile phones, Talluri is optimistic that the San Diego-based company will rise to the challenge.

“That’s how most semiconductor companies are,” he said. “It’s a model that we know how to set up and CSR is one such company. The idea is you have multiple people each responsible for a segment and pick the technologies that they need … and you build the distribution channels and let the machine start rolling.”

He admits it may not be as “exciting” as winning or losing a chip inside a handset, but it is a far more stable business and as a veteran of Texas Instruments he’s been there before. First with Atheros and now with CSR, Qualcomm is adapting to what may be a far less exciting path, but one that could provide greater diversity and stability.