중국이 서방의 IT독주를 우려해 다른 지역에서는 다 허가를 득하고도 결국 접은 큰 딜들이 점점 많아지는데, 투자가들의 한이 계속 쌓이고 쌓여서 어떤 분노로 폭발할지 궁금하다. 향후에 중국경제가 회복되면 좋은 기업을 인수하며 성장할 수 있는 좋은 옵션을 불살라 버려서 자국내에서만 쓸 수 있는 생태계밖에 답은 없을것 같다.

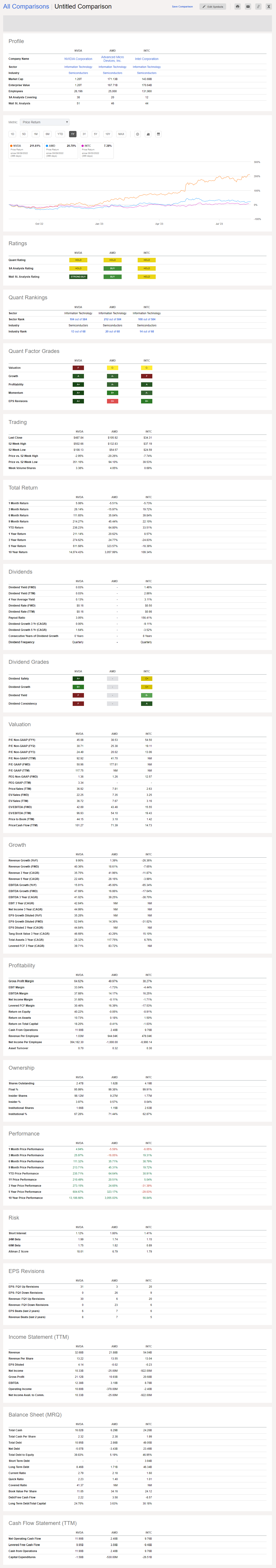

| Deal |

Year |

Value |

Penalty |

Reason for rejection |

| Qualcomm's acquisition of NXP Semiconductors |

2016 |

$14 billion |

|

National security concerns |

| SoftBank's acquisition of ARM Holdings |

2017 |

$22 billion |

|

Concerns about data security |

| Sale of Grindr to Beijing Kunlun Tech |

2018 |

$620 million |

|

National security concerns |

| ByteDance's acquisition of Musical.ly |

2020 |

$1 billion |

|

Concerns about competition |

| Intel - Tower Semiconductor |

2022 |

$5.4 billion |

$353M |

No reason |

현재 진행중인 브로드컴(Broadcom, Avago, AVGO) - VMWare 합병도 어떻게 될지 지켜보면 재미있다. 중국은 일관성있게 좀 될것 같은 회사들이 모이면 안된다는 말은 안하고 아예 대답을 안한는 방식인데...

-------------------

Sure, here are some tech M&A deals that were broken due to the Chinese government not approving the deals in a timely manner:

These are just a few examples of tech M&A deals that have been broken due to the Chinese government not approving the deals in a timely manner. The Chinese government has become increasingly strict in its review of foreign investment in recent years, and this has made it more difficult for foreign companies to acquire Chinese businesses.

In addition to national security and data security concerns, the Chinese government may also block M&A deals if it believes that the deal could give the foreign company too much control over a key industry or technology. The Chinese government is also concerned about the loss of jobs and technology when Chinese companies are acquired by foreign companies.

As a result of these concerns, the Chinese government has taken a more cautious approach to approving foreign investment in recent years. This has made it more difficult for foreign companies to acquire Chinese businesses, and it has also led to the break-up of some high-profile M&A deals.